Putting it together

Now that we have a basic understanding of bar servers, strategies and money managers, let's put them together to actually run our first backtest. Assuming you have followed the instructions in Installation and have created an empty .NET Console application, you can paste the following into the Program.cs file, overwriting the code stub produced by Visual Studio.

using Balsam;

using Balsam.DataServers;

using Balsam.MoneyManagement;

using System;

using System.Drawing;

internal class Program

{

static void Main(string[] args)

{

//change the directory as needed to point to your own data

var server = new CsiBarServer(@"c:\data\csi\current");

var data = server.LoadAll();

var strat = new SimpleSma();

strat.MoneyManager = new FixedFractional() { PercentToRisk = 0.001 };

strat.RunSimulation(data);

}

}

class SimpleSma : Strategy

{

public int ShortLength { get; set; } = 50;

public int LongLength { get; set; } = 200;

protected override void OnStrategyStart()

{

Col1 = Sma(Close, ShortLength);

Col2 = Sma(Close, LongLength);

Col3 = Atr(21);

Plot(Col1, 0, Color.Blue);

Plot(Col2, 0, Color.Red);

Plot(PlotInstruction.PlotStops);

}

protected override void OnBarClose()

{

if (CrossAbove(Col1, Col2).Last)

{

Buy();

}

else if (Col1.Last < Col2.Last)

{

Sell();

}

ExitOnStop();

}

protected override void OnPositionOpening(Position position)

{

base.OnPositionOpening(position);

position.Stop = position.Entries.AvgGrossPrice - Col3.Last * 3;

}

}

Code discussion

Namespaces

Namespaces are used to group functionality and are accessed with the using keyword in C#. We first import the Balsam namespace which contains the Strategy class as well other foundational classes we have already covered including TimeSeries, BarSeries and Instrument. We also import Balsam.DataServers which contains bar servers and data related classes as well as Balsam.MoneyManagement for accessing built-in money managers. Finally, the System.Drawing namespace is included to be able to easily reference colors for charting.

Program.Main

The static void Main(string[] args) method is the primary entry point for a C# console application and is auto-generated by Visual Studio. Here we can kick off our first portfolio backtest in only five lines of code. But before we do, let's discuss a few modifications made to our toy SimpleSma strategy to make it slightly more realistic.

OnStrategyStart()

Rather than using hard-coded constants for the moving average lengths, we converted the Sma calculations to use two new properties, ShortLength with a default of 50 and LongLength with a default of 200. While the code is equivalent to the original system, using properties allows us to easily change the lengths and will also support optimization. Next, we assign a 21 day average true range calculation to Col3 and then add three plot instructions which will be used when charting the strategy.

OnBarClose()

In the original SimpleSma example, the entry logic used a comparison of Col1.Last > Col2.Last (i.e. the 50 day SMA is greater than the 200 day SMA.) We've modified this to leverage a built-in indicator to detect crosses of one series versus another. The CrossAbove indicator returns a BooleanSeries. Notice how we reference .Last to get the most recent value relative to the current date being tested. Using crosses instead of a simple comparison is a common trick to ensure you enter a trade only once when the initial condition is true. This becomes particularly important when using a stop. Otherwise, if you get stopped out of a trade, you could potentially re-enter on the very next bar when using simple comparison logic like Col1.Last > Col2.Last.

We also add a call to ExitOnStop(). This is a built-in helper method which evaluates the current position and then calls the appropriate stop method depending on the position side. If we were to code this manually, it would look something like this:

if (MarketPosition == PositionSide.Long)

{

SellStop(CurrentPosition.Stop);

}

else if (MarketPosition == PositionSide.Short)

{

CoverStop(CurrentPosition.Stop);

}

MarketPosition returns an enum value of Long, Flat or Short. You can use this to check if you have a position (evaluating that CurrentPosition is not null works too). Finally, we call the appropriate stop order method, passing in the stop price to be used. But it's a lot simpler to just call ExitOnStop() which does all this work for you. You'll find the backtester has a lot functionality like this designed to hide the underlying complexity to speed the research process.

OnPositionOpening()

OnPositionOpening() is called when an opening trade is executed, thereby creating a new position. This is a perfect place to initialize a stop loss or target. The Position object has both Stop and Target properties which can be leveraged for this functionality. Here we set a protective stop at 3 ATR's off the gross entry price (ignoring slippage and commissions.)

Running a backtest

With the strategy code explanation out of the way, let's come back to how we actually run a backtest. There are generally three parts: a strategy, a money manager, and the data to feed it. In this example we are using a CsiBarServer to load end-of-day backadjusted continuous futures contracts exported from CSI's Unfair Advantage software. You will likely need to adjust the data directory as required to point to your own files. See Data for examples of other BarServers that could be used as alternatives. If you are using CSI, consider adding a global instrument file included with the backtester to your project as described in Instruments.

var server = new CsiBarServer(@"c:\data\csi\current");

var data = server.LoadAll();

Next we create an instance of our strategy, assign a fixed fractional money manager risking 10 basis points per trade, and pass in the data to be tested to RunSimulation().

var strat = new SimpleSma();

strat.MoneyManager = new FixedFractional() { PercentToRisk = 0.001 };

strat.RunSimulation(data);

Hit F5 in Visual Studio to build and run the program. It should only take a few seconds to run and when the simulation is complete, a backtest report will be exported to Excel. Congratulations! You have just run your first backtest.

Backtest report

Backtest reports are generated using customizable Excel templates. Assuming you added the Templates folder to the Visual Studio project in the Installation step, the backtester will use Templates\MoneyManagementTemplate.xltx by default.

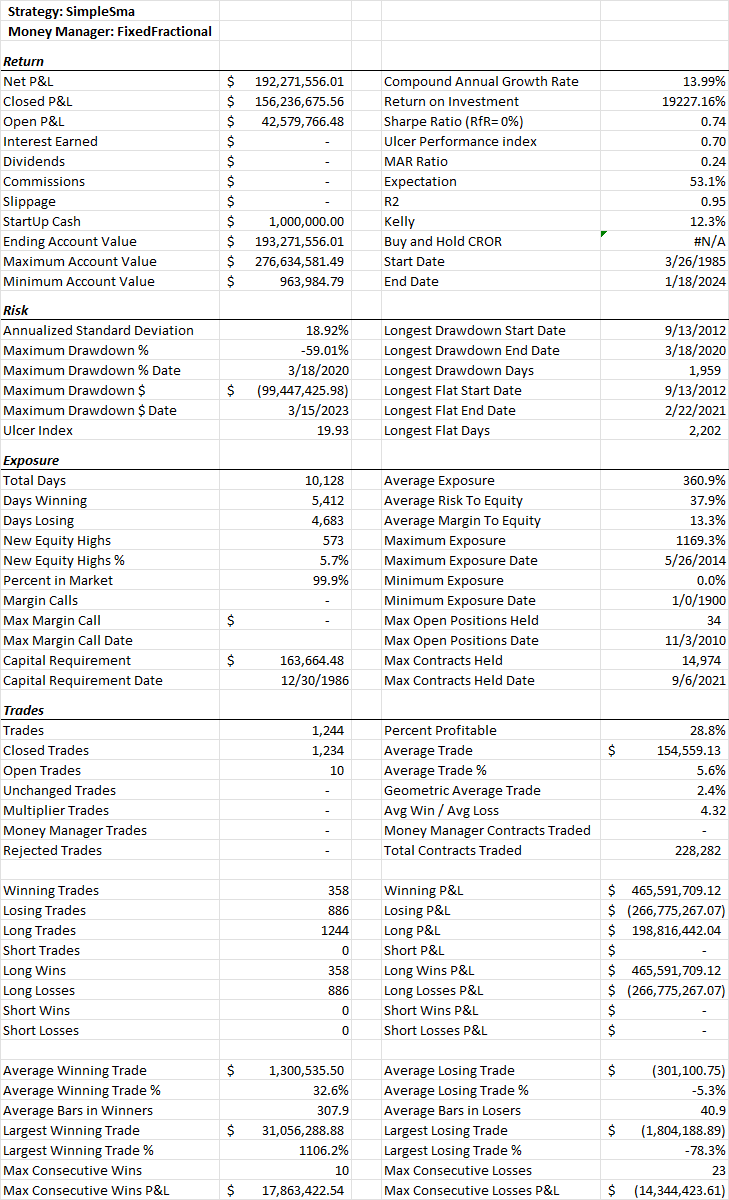

Performance Stats

'Performance Stats' is the first worksheet of the backtest report and contains key portfolio metrics and trade statistics. The default money management template looks like this:

Equity Curve

The next page contains a chart of the equity curve.

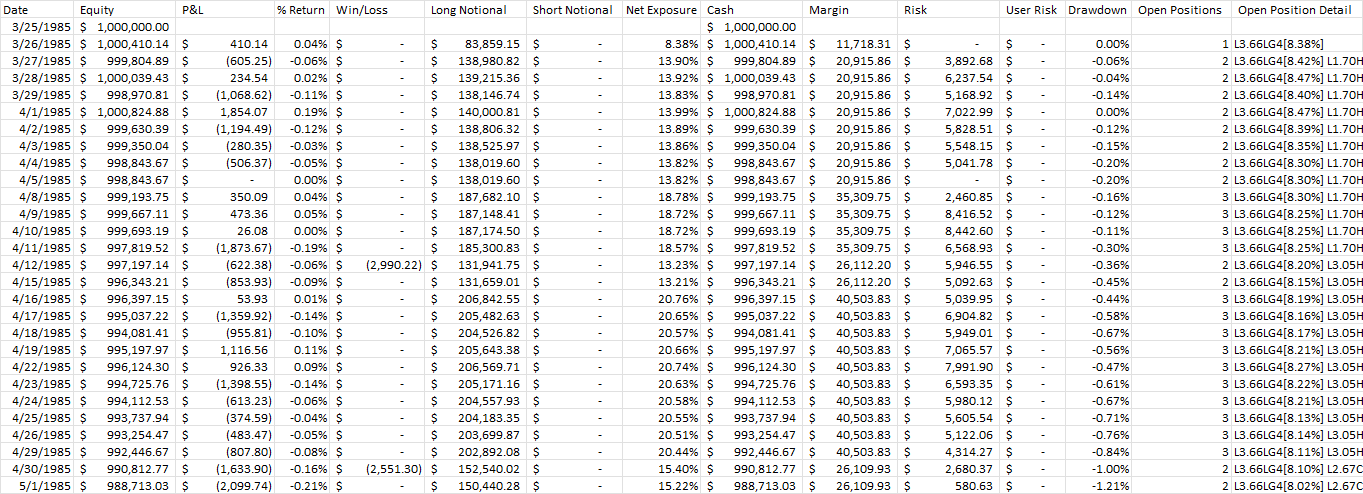

Equity Detail

The Equity Detail tab contains daily equity, return, exposure, margin, and position information.

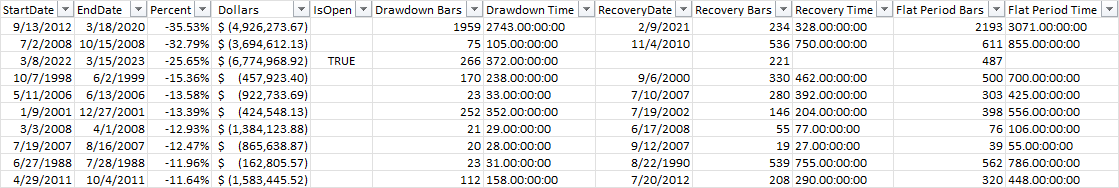

Drawdowns

The Drawdowns tab contains detailed information on all drawdowns in the equity curve sorted by max percentage drawdown.

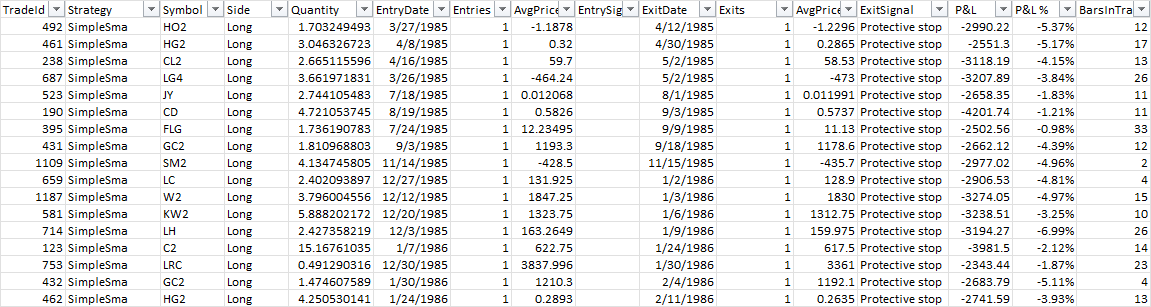

Trade Detail

The Trade Detail tab contains detailed information on individual trades.

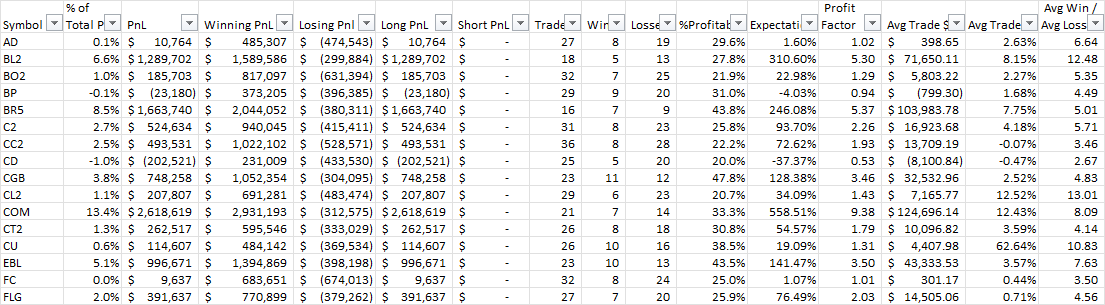

Symbols

The Symbols tab shows performance statistics aggregated by symbol. Group, Sector, and Instrument performance summaries can also be enabled by setting the appropriate property in MoneyManager.Options.

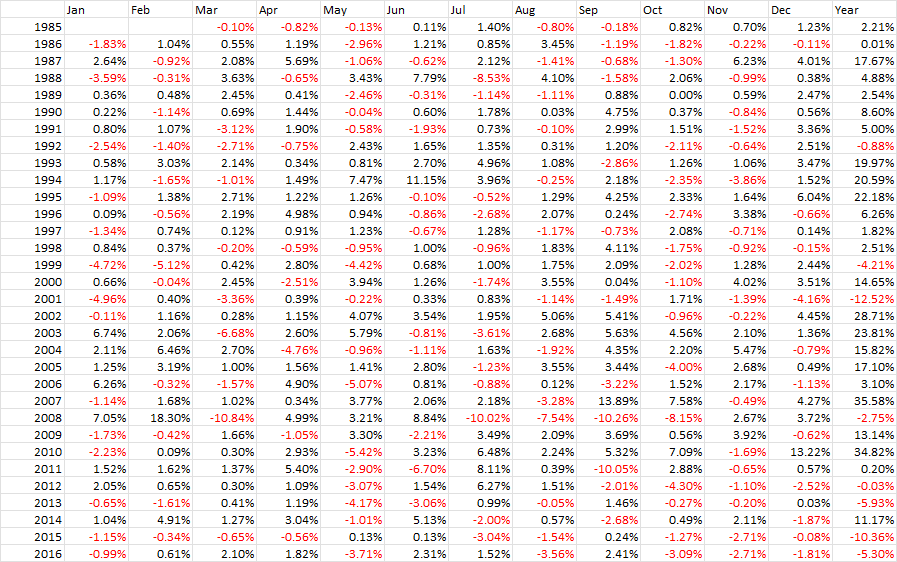

Performance grid

Next we have a standard performance grid allowing you to see monthly and annual performance at a glance.

Settings

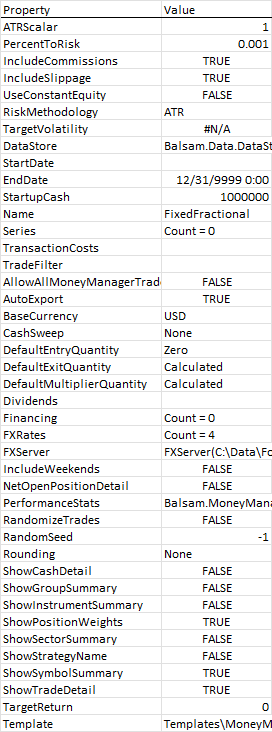

The Settings page contains various settings used by the money manager that generated the report.

Alternative templates

When running many tests you may prefer to work with a streamlined template displaying a few key stats in a single column. This makes it easier to copy and paste results within Excel for side-by-side comparisons. See the ComparisonTemplate.xltx template for one possible example. See Customizing backtest reports for more information on customizing templates.